A bachelor's degree in business is excellent for entry-level and mid-career business professionals. However, if you want to further your education and expand your career opportunities, you are likely considering graduate school.

Do you dream of becoming a successful entrepreneur or making strides in the field of international business? If so, you may look to earning your MBA (Master of Business Administration) degree.

Obtaining an MBA is a common path for many people interested in the finance world. However, it's not your only option. Have you ever considered a Master of Science in Finance degree?

Below, we'll explore the two programs and their differences. Reading through this guide will help you select the right degree based on your career goals, salary expectations and other essential factors.

Defining an MBA and Master of Science in Finance

An MBA, or Master of Business Administration program, is an all-encompassing business program for graduate students. Your institution may cater its MBA program to different career interests, including IT, operations, management, strategy, entrepreneurship, finance or marketing.

A Master of Science in Finance (MSF) program is a more finely tuned program that focuses on finance-related areas.

MBA vs. Master of Science in Finance — Key Differences

Explore the key differences between an MBA program and a Master of Science in Finance program below:

Specialization

Think of an MBA program as a large oak tree and a Master of Science in Finance program as a single branch. They both relate to business, but a Master of Science in Finance program is much more specialized. An MBA program covers all things business, while a Master of Science in Finance program focuses on honing knowledge of the finance sector.

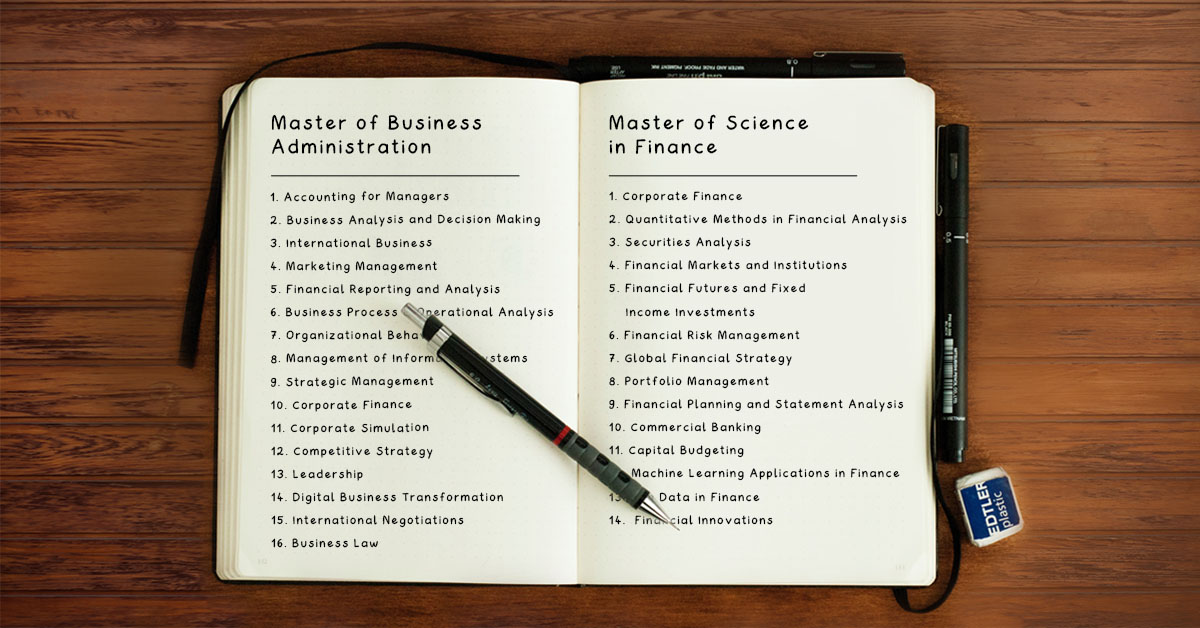

You can get a better idea of what each program offers by exploring some of the most common courses:

Common MBA Courses

- Accounting Concepts for Managers

- Operations Management and Quality Enhancement

- Marketing Management

- Risk Management and Legal Compliance

- Operations and Supply Chain Processes

- Data Analytics for Business

- Organizational Behavior and Leadership

Common Master of Science in Finance Courses

- Financial Modeling and Analytics

- Theory of Finance

- Estate Planning

- Portfolio Management

- Global Finance Strategy

- Financial Options and Futures

- Advanced Financial Risk Management

- Public Finance

- FinTech

Completion Speed

Standard MBA programs take two years to complete. On the other hand, a standard MSF program only takes one year to finish. However, your experience may vary slightly, depending on the specific program.

Popularity

Most students view the MBA program as the “traditional” route to take when applying for business graduate school. It’s certainly an acceptable one, but it’s not your only option.

Many students are turning to specialized MSF programs to continue their business education and make themselves stand out in a competitive market.

The MSF degree is growing in popularity due to multiple factors. One reason is the increasing popularity of cryptocurrency, which demands more specialized knowledge. Another factor is the increased interest in financial valuation and analysis among major corporations.

According to U.S. News & World Report, employers love potential employees with Master of Science in Finance degrees. In one study, the majority of employers wanted to increase or match the number of recent finance graduates they took on in the year before.

So, if you’re looking for a unique way to distinguish yourself in the competitive finance job industry, a Master of Science in Finance degree might be the way to go.

Flexibility

An MBA program focuses on more comprehensive knowledge, while a Master of Science in Finance program involves more specialized knowledge.

The Master of Science in Finance program has a (traditional) faster completion rate, so you can enter your long-term career more quickly.

Whichever program you decide to pursue, you can complete it on your own terms. Before you start either degree, you should evaluate the time you have available and find a program that works with your schedule. Otherwise, you risk falling behind and failing to complete the program altogether.

If you're passionate about obtaining a solid education in finance, you can adjust your schedule to make it work and reap the rewards in the long run.

MBA and Master of Science in Finance Admission Requirements

If one of these programs has captured your interest, you may be wondering how to get accepted into one.

There isn't a single formula to memorize that'll land you a spot in a program. Every institution will consider and prioritize different factors. Even then, all graduate students come from unique backgrounds and take different paths toward acceptance.

In general, you'll have to submit the following information when applying for an MBA or Master of Science in Finance program:

- Proof of superior academic ability (your GPA from your undergraduate studies)

- GRE/GMAT test scores (sometimes waived if you have enough relevant work experience)

- Experience (professional work history, internships, organizational involvement and summer jobs)

- Letters of recommendation from industry professionals (your past/current bosses or undergrad professors)

Many programs will also require a personal statement and interview with one of the institution's board leaders.

Familiarize yourself with your institution's application process so that you'll know what to expect. Reach out to the school's admissions representatives and speak with past applicants. This way, you'll get a better idea of the application process and learn how to improve your chances of getting accepted.

The Benefits of Earning a Graduate Degree in Finance

Isn't a bachelor's degree in business enough? Why bother attending graduate school?

People may wonder if a graduate business degree is necessary. While it's not a requirement for all jobs in business fields, it can give you various advantages.

Earning your MBA or Master of Science in Finance can present many opportunities, including:

- A promotion or salary raise in your current position

- Enhanced job performance

- New skills to move up or transition to a different position in your field

- Improved leadership skills for your current or future company

- New strategies and viewpoints

- A network of professional contacts

MBA Salary Expectations and Career Outlook

Having an MBA offers promising salary expectations, as the average starting salary for graduating business school students was $87,966 in 2020.

This number includes bonuses. But it is important to note the figure represents graduates who attended full-time MBA programs.

So, what will you be doing to earn all this dough? Students with an MBA have many careers to explore, including:

- Human Resource Manager: As an HR manager, you'll oversee employee-focused services (like benefits and training), track regulatory compliance, and create hiring standards.

- Executive Leader: An executive leader helps manage department heads, participates in contract negotiation and sets the company's budget.

- Sales Manager: Sales managers are the backbones of regional offices and global operations alike. They play essential roles in moving goods from the business to the customer and implement strong communication skills.

- Management Analyst: A management analyst works tirelessly to perfect revenue-boosting strategies and optimize business performance.

Master of Science in Finance Salary Expectations and Career Outlook

MSF graduates tend to earn less right after graduation in comparison to MBA graduates. This discrepancy exists because MBA degree holders tend to have jobs already, and they receive promotions to mid-level management roles. MSF students tend to be younger and usually land entry-level positions and work their way toward upper-level roles, eventually closing this salary gap.

MSF graduates still earn impressive salaries. The average national salary for a Master of Science in Finance graduate is around $80,000. Like with an MBA, you can also increase your earnings with promotions, bonuses and raises.

Here are some common careers you can enter with a Master of Science in Finance:

- Financial Advisor: You'll teach others how to manage their money. Help them save for their retirement and children's college education, or help them complete their tax forms responsibly.

- Actuary: An actuary implements financial and statistical theories to determine the likelihood of specific financial events. In this role, you'll help your employer assess the risks and costs involved with making financial decisions.

- Corporate Investment Banker: This career lets you implement short- and long-term investment plans to help a company reach its financial goals.

- Financial Analyst: In this role, you will create financial models to forecast revenues and expenditures in order to determine costs and create budgets for projects within your company or corporation.

MBA or Master of Science in Finance — Which Is Right for Me?

Now that you've read through the differences between these two programs, you may be wondering which is suitable for you.

There isn't a simple answer. You'll need to consider your current position, career goals and the time you're willing to commit.

For example, let's say you're an enthusiast of corporate finance and investing, and you don't want to be in graduate school for too long. You'd likely benefit from seeking a Master of Science in Finance degree.

On the other hand, let's assume you're a team leader at a retail store and want to work your way toward a management position. You'd likely benefit from an MBA program, as you can continue working in your current position. And, you'll gain valuable knowledge of leading a company on a larger scale.