About the SBDC at FIU

We provide consulting in:

- Start-up assistance

- Business strategy

- Financial management

- Marketing and sales

- Access to capital

- International trade

- Government contracting

- Operational efficiency

Our local team of consultants tailor their expertise to your business challenges.

Getting Started

Visit our website at https://sbdc.fiu.edu. On the website you can review our available services and consulting team backgrounds. Then click on the "Register Here" button to request a consultation.

Costs & Eligibility

Most FSBDC at FIU services are offered at no cost to clients.

The center's sole fee-based, specialized service is an Export Marketing Plan (EMP) for businesses looking to expand to new export markets or export for the first time. More information on the EMP service is available here: https://floridasbdc.org/services/consulting/international-trade/

Location & Contact

We serve Miami-Dade and Monroe Counties and have offices in both counties:

Miami-Dade

Address: 1101 Brickell Avenue, South Tower, Suite 300, Miami, FL 33130

Hours: Monday–Friday: 9 AM to 5 PM

Monroe County

Address: 300 Southard St., Suite 205, Key West, FL 33040

Hours: By appointment only

Email Bonnie Barnes: bonnie.barnes@FloridaSBDC.org to schedule an appointment.

Call us at 305–779–9230, Monday–Friday, 9 AM–5 PM.

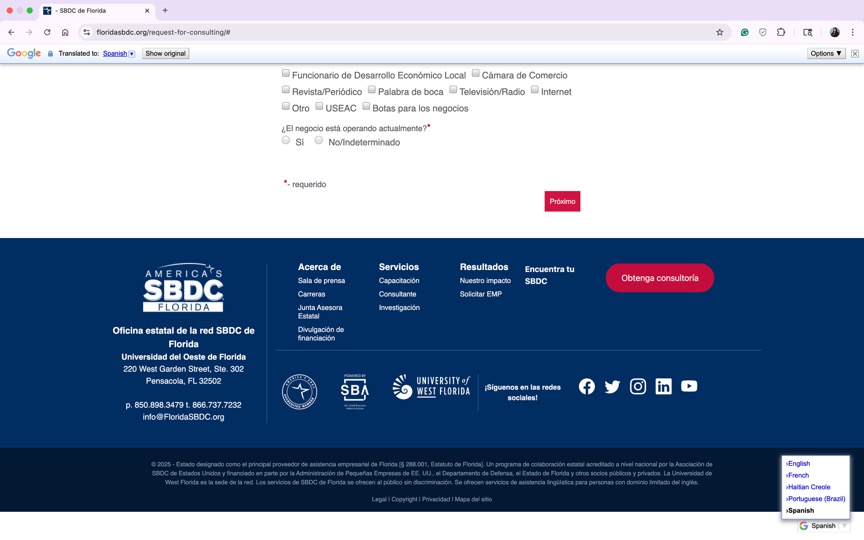

A: Yes. A Spanish-language preregistration form is available on our website. Scroll down to the very end of our website and click on the desired language as shown in the picture below:

B: Sí, ofrecemos pre-registro en español. Puede encontrar el formulario de preregistro en español en nuestro sitio web bajando hacia el fondo de la pantalla y seleccionando el idioma que prefiere.

Funding Programs & Special Services

Capital Access

Qualifications & Requirements

Events & Trainings

Stay connected with us through our social media platforms to receive timely updates on upcoming webinars, training sessions, and community events.

Follow us on:

- LinkedIn: Florida SBDC at FIU

- Instagram: @SBDCatFIU

- Facebook: Florida SBDC at FIU

To read our latest feature, visit our GrowBiz Blog at growbiz.fiu.edu

However, becoming an SBDC client offers additional benefits, including:

- No-cost one-on-one consulting with our business experts

- Customized business assessments and growth strategies

- Access to exclusive tools, data, and market research

- Guidance on funding, marketing, and operations tailored to your business needs

If you’re interested in seeing whether you’re eligible to become an SBDC client, we encourage you to complete a consultation request form.

👉 Request a Consultation